Homeowners experiencing financial difficulties and unable to keep up with mortgage payments often have two main options: a short sale or foreclosure. It is important to distinguish between a short sale and foreclosure to make informed choices, reduce financial impact, and safeguard credit health. The difference between short sale and foreclosure lies mainly in the homeowner’s level of control, credit implications, and long-term financial consequences.

What Is a Short Sale?

Key Points About Short Sales:

- Requires lender approval before selling the property.

- The process can take 90 to 120 days or longer.

- Less damaging to the homeowner’s credit score than foreclosure.

- The homeowner may need to negotiate to avoid a deficiency judgment.

- The homeowner can stay in the home until the sale is completed.

Short sales offer homeowners a potential way to reduce financial losses while maintaining some control over their housing situation. Many lenders prefer short sales over foreclosures because they are less costly and time-consuming.

What Is a Foreclosure?

Foreclosure is a legal procedure started by the lender when a homeowner repeatedly misses mortgage payments, typically for three to six months. The lender files a Notice of Default and proceeds with legal action to reclaim the property. If the debt is unresolved, the home is auctioned, or ownership reverts to the bank.

Key Points About Foreclosures:

- The lender takes legal control of the property.

- Moves faster than a short sale as lenders seek to recover losses.

- Significantly damages the borrower’s credit score, impacting future loan eligibility.

- The homeowner is required to vacate the property.

- The home is typically sold at auction and may only be purchased with cash.

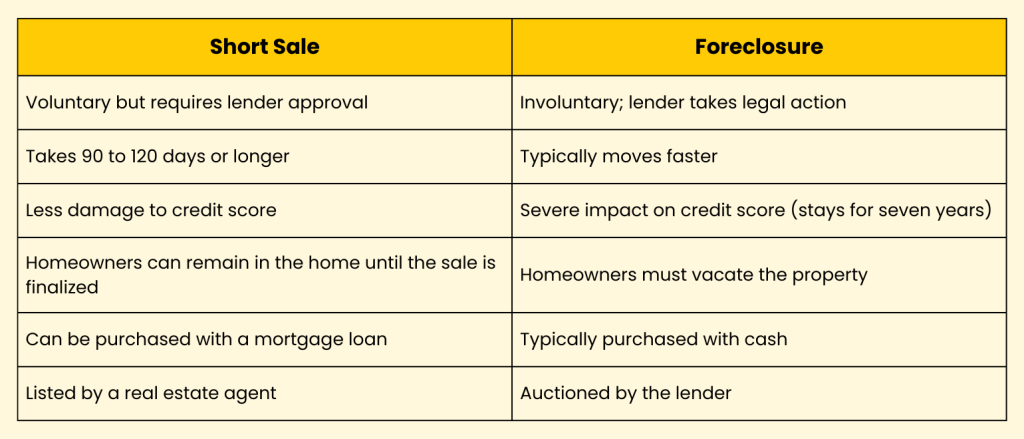

Short Sale vs. Foreclosure: A Comparison

Which Option Is Better?

The choice between a short sale and foreclosure depends on the homeowner’s financial situation and long-term goals. A short sale generally results in less damage to credit and allows the homeowner to avoid the stigma of foreclosure. However, it requires lender cooperation and can be time-consuming. Foreclosure, while faster, has long-lasting financial repercussions and forces the homeowner to leave the property.

About LandLeader

LandLeader is the premier network of land experts across North America, specializing in helping buyers and sellers navigate the complexities of real estate transactions. Whether you are looking to buy, sell, or invest in land, our experienced professionals provide unmatched expertise and dedicated service.