When dealing with real estate transactions, one critical factor to consider is what is a lien on property and how it affects buyers and sellers. A lien is a legal claim placed on a property due to unpaid debts, which can complicate the sale or transfer of ownership. Real estate agents must understand how liens work, their impact on transactions, and how to resolve them to ensure smooth property sales.

Understanding Property Liens and Their Impact

A property lien is a public record that gives a creditor the right to claim a property if the owner fails to pay off a debt. Liens can be voluntary (agreed upon by the property owner, such as a mortgage) or involuntary (placed by a creditor without the owner’s consent, such as a tax lien).

When a property has a lien, the owner may not be able to sell or refinance until the debt is resolved. Real estate agents must be aware of how liens affect property transactions and how to check for and remove them.

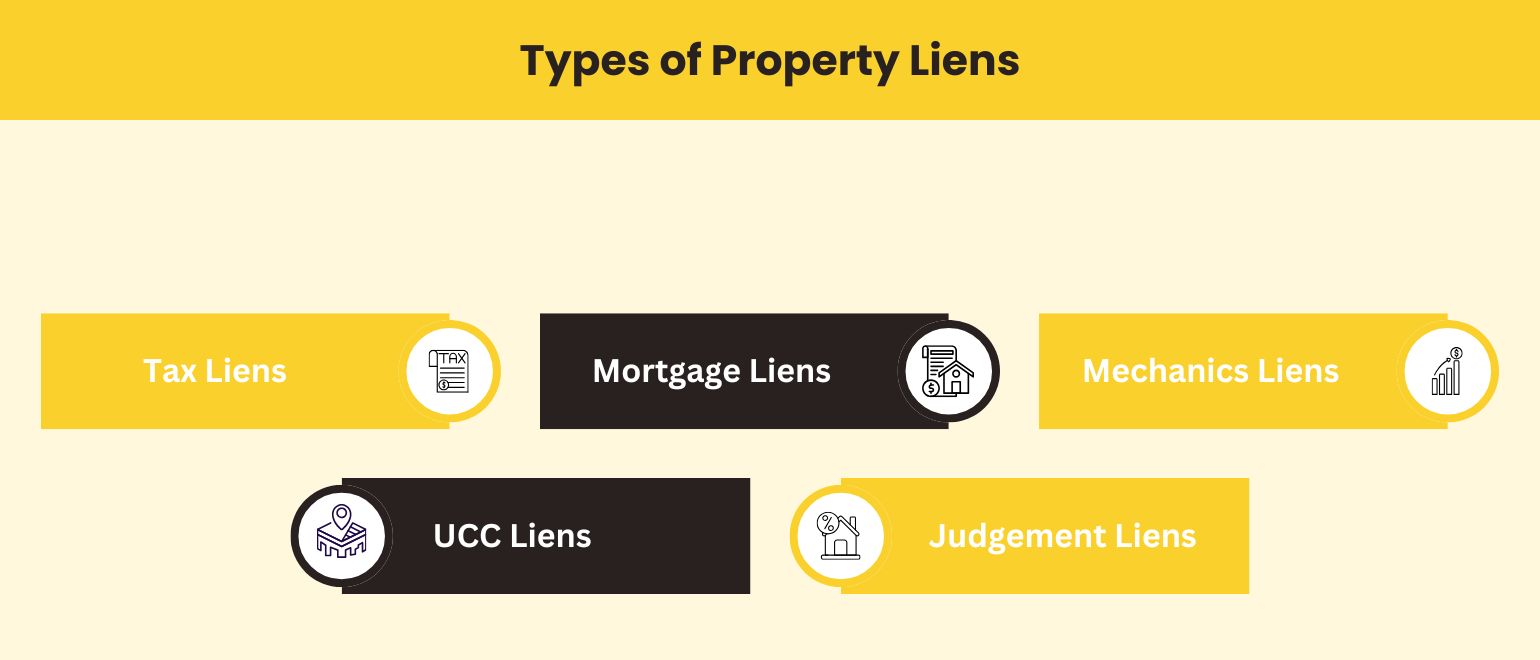

Types of Property Liens

There are different types of liens, each with its own implications:

- Mortgage Lien – A voluntary lien where a lender claims a property until the mortgage is fully paid.

- Property Tax Lien – The government places this lien if property taxes are unpaid, taking priority over mortgage liens.

- IRS Lien (Federal Tax Lien) – A claim from the IRS for unpaid federal taxes.

- Judgment Lien – A court order allowing a creditor to claim a property due to unpaid debts.

- HOA Lien – A homeowners association (HOA) places this lien when fees or dues are unpaid.

- Contractor’s Lien (Mechanic’s Lien) – A claim by contractors or builders for unpaid construction work.

How Do Property Liens Affect Real Estate Transactions?

Liens can delay or even prevent a sale if not addressed. Buyers may hesitate to purchase a home with an active lien, as they could become responsible for the unpaid debt. Mortgage lenders may also refuse to finance properties with liens, making it difficult for buyers to secure loans.

For sellers, resolving liens before listing a property is crucial to ensuring a smooth transaction. Real estate agents should educate clients about the impact of liens and how to handle them.

Buying and Selling Properties with Liens

Buying a Property with a Lien

- Buyers should conduct a title search to check for liens before making an offer.

- They may negotiate with the seller to clear the lien before closing.

- Some buyers may proceed with a lien if they plan to settle the debt or purchase the property at a lower price.

Selling a Property with a Lien

- Sellers should pay off the lien or negotiate a settlement with creditors.

- If they can’t afford to pay, they may consider short sales or lien release programs.

- Agents should verify the title is clear before listing the property.

Real estate agents and buyers can check for liens using several methods:

- Hire a Title Company – A professional title search reveals any active liens on a property.

- Check County Records – Many county offices maintain online databases where you can search for liens.

- Visit the County Recorder’s Office – If online records are unavailable, visiting in person is an option.

- Use Third-Party Property Record Services – Some websites provide lien reports for a fee.

How to Remove a Lien from a Property

Removing a lien depends on its type and validity. Here are the common steps:

- Pay Off the Debt – The quickest way to remove a lien is to pay the owed amount.

- Negotiate with the Creditor – Some creditors may accept a settlement for less than the full amount.

- Request a Lien Release – Once the debt is paid, obtain a lien release document from the creditor.

- File the Lien Release – Submit the document to the county recorder’s office to update public records.

- Dispute Invalid Liens – If a lien is unjustified, legal action may be necessary to remove it.

LandLeader: Your Trusted Partner for Navigating Property Liens

Understanding liens is essential for real estate agents to help clients navigate complex property transactions. Whether checking for liens, resolving them, or advising buyers and sellers, agents play a key role in ensuring a smooth sale.

Why Choose LandLeader?

As the premier land marketing platform, LandLeader connects buyers and sellers with expert real estate professionals specializing in rural, recreational, and agricultural properties. Our nationwide network ensures that real estate transactions are handled efficiently and professionally, even when liens are involved.

How LandLeader Helps Agents and Clients:

- Access to trusted real estate experts who understand property liens and title issues.

- Comprehensive marketing tools to showcase properties and reach the right buyers.

- Guidance on lien resolution to help sellers prepare their properties for sale.

By staying informed and proactive, agents can help clients overcome lien-related challenges, ensuring successful and profitable property transactions. Whether you’re buying, selling, or representing a client, LandLeader is here to support you every step of the way.